Personal Finance

All Personal Finance Content

Winter Car Kits

Prepare a winter car kit to keep yourself safe when traveling during the winter.

Save Money by Winterizing Your Home

Fall is the perfect time to begin preparing your home for colder winter temperatures and the higher energy costs that come with them. Learn some expert tips for preparing your home today!

Budget Adjustments When Inflation Impacts Prices

The prices of regularly purchased items have slowly increased over the past year due to inflation. When this happens, it is time to review your budget to make adjustments in spending.

End of Life Documents You Should Have in Place

COVID-19 infection and mortality rates fill the news programs. Across South Dakota and the nation, people are have made changes to their lifestyle and the way they accomplish many everyday activities. In response to this illness and the potential for long-term hospitalization and even death, individuals over 18 should also ensure their end of life documents are up-to-date.

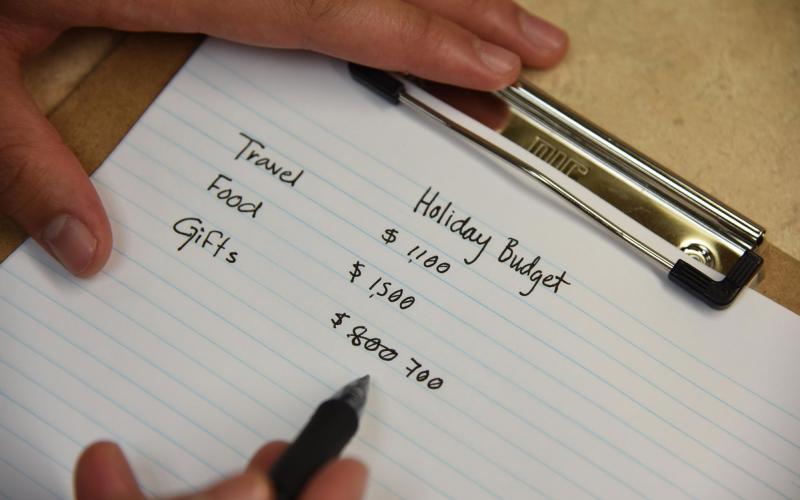

Planning for Holiday Expenses on a Tight Budget

The holidays are a time to spend with family and friends sharing good food and gifts. Unfortunately, this time of sharing can create stress for individuals and families who are living on a tight budget. Planning ahead and making decisions about spending will help the holidays be more enjoyable.

Public Service Loan Forgiveness Program

Learn about the key qualifications for the U.S. Department of Education's Public Service Loan Forgiveness program and view some helpful tools and resources for determining if you qualify.

Retirement Tips: Surviving the First Year

Retirement is one of the most important transitions a person will experience during their life. A little forethought can really help a person reconcile their new identify as a retired person.

Shopping for Car Insurance

Does affordable car insurance mean the cheapest price, or does it mean getting the most for your money?

Saving for Large Purchases

Large purchases involve setting goals, making plans and following a strategy to keep your savings plan on pace.

Planning for Retirement

No matter what your age or when you plan to retire, now is the time to begin saving for retirement. Learn. some tips to help you become more financially secure as you prepare for retirement.