Personal Finance

All Personal Finance Content

SDSU Extension collaborates to offer free virtual financial and legal planning education

November 01, 2024

South Dakota State University Extension is offering a free virtual program to help adults over 40 organize their legal and financial documents.

Replacing Legal and Financial Documents in South Dakota

Fact sheet covering various document types that may be lost, destroyed, or stolen and provides sources for information to replace them.

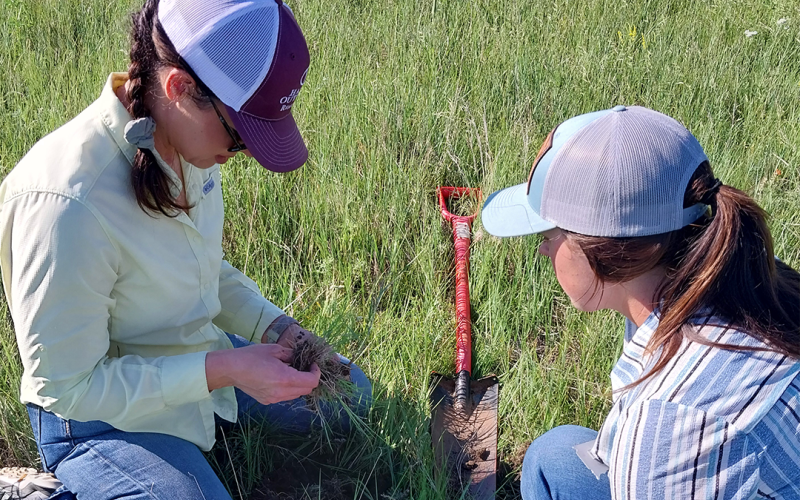

SDSU Extension to host Annie’s Project in Colton

September 06, 2024

Annie’s Project is designed to empower women in agriculture through education, networking and resources. The program helps women build the confidence to become more involved in their family’s agricultural enterprises.

Register now for SDSU Extension Annie’s Project in Eagle Butte

September 04, 2024

Annie’s Project is designed to empower women in agriculture through education, networking and resources. Robin Salverson, SDSU Extension Cow/Calf Field Specialist, said the program helps women build the confidence to become more involved in their family’s agricultural enterprises.

Student Loan Repayment

Many people can be intimidated by student loans and the repayment process. Learn about the different types of student loans and repayment plans the U.S. Department of Education offers borrowers.

Health Insurance and the Marketplace

The Marketplace is a service operated by the U.S. Department of Health and Human Services where you can shop and enroll for health insurance. Learn what's covered in marketplace plans, how to enroll, and where you can get help.

Protecting Yourself From Frauds and Scams

Tactics used by scammers have shifted drastically in recent years, with online scams rising 87% since 2015. Learn how to ecognize and protect yourself from some of the most-common scams in South Dakota.

What You Need to Know About Social Security for Retirement Planning

Social Security benefits are money you get from the government when you retire. You get them if you have worked and paid Social Security taxes for a certain amount of time.

Flood Insurance

The higher amounts of snow this year will increase the chance of flooding and the potential water damage to homes and residential properties. Now is the time to consider purchasing a flood insurance policy.

Flood

View resources to prepare for and recover from flood situations.