Personal Finance

All Personal Finance Content

Health Savings Account vs. Flexible Savings Account: Which is best for me?

Having a health insurance plan does not mean that all medical expenses are covered. Health savings accounts (HSA) and flexible savings accounts (FSA) are designed to help consumers budget for deductibles, co-pays, prescription costs, out-of-pocket costs, and other unexpected medical expenses.

Financial Planning Tools

A high level of financial literacy, the ability to make sound financial decisions based on your knowledge, will improve your financial well-being.

Debt Management

Many people face a financial crisis at some point in their life that can make it difficult to pay bills.

What to Do If You’ve Lost Your Health Insurance

Losing health insurance can be scary, and your well-being depends on taking the proper steps to protect your family. Learn about some coverage options to consider if you've recently lost your health insurance.

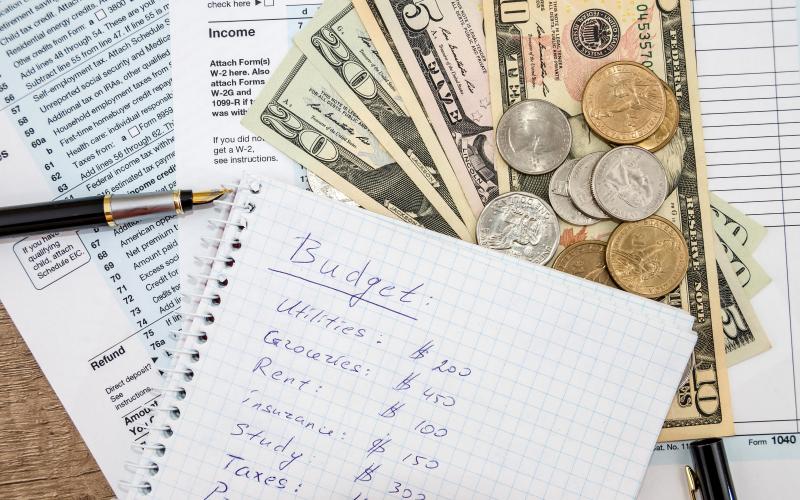

4 Tips for Managing Money on a Low-Income

The number of families in the United States whom are in poverty is increasing. Nearly one-third of all working families or 10.4 million families are considered low-income.

What You Need To Know To Enroll in Health Insurance Through the Marketplace

The Health Insurance Marketplace allows consumers to complete a streamlined application to determine qualification for coverage under different health care plans. Learn some tips for getting started during the open enrollment period of November 1 through January 15.

12 Tips to Simplify Your Finances

With each passing day, the demands on our time and financial resources increase causing us to do more in less time or spend more money on fewer items.

Insurance

Not sure where to start when purchasing insurance? Find out the basics of how insurance works, what it covers and what types are available.

Keeping Your Financial Records Secure

When a family emergency or disaster occurs, having quick access to important financial documents is essential.

Wise Spending Habits

Does your paycheck run out before the end of the month? Do you spend more than you earn? Your wants may possibly be getting in the way of your needs. Priorities will need to be set to help manage money. Almost everyone can find some expenses to cut or reduce.