The following procedural guidance guides local 4-H clubs and affiliates as they organize, charter, report, and eventually disband. Collectively, these practices ensure that South Dakota 4-H clubs and affiliates are meeting appropriate federal or state guidelines and program best practices.

Organizing

Did you know?

The federal Smith-Lever Act (1914) and subsequent related federal statutes provide for barrier-free access to positive youth development for all the nation’s youth through the 4-H program. Each state’s land grant university (in our case South Dakota State University) has been granted the authority by the US Department of Agriculture (USDA) to organize 4-H in a way that reaches the broadest audience possible. Because staffing resources are generally limited by available governmental funds, most states encourage the formation of volunteer-led clubs and affiliates which significantly strengthen the outreach mission of the 4-H program. These ‘duly chartered’ 4-H clubs and affiliates support the mission of positive youth development in local communities across the state. If you are reading this document, chances are you would like to become a part of this mission!

Why and when to organize?

There is an old proverb that suggests, “it takes a village to raise a child.” For over 100 years the 4-H program has enjoyed the positive influence of caring peers, volunteers, supporters, and staff. The more positive influences that surround an individual youth, the better the life outcomes. Ultimately, this is why 4-H groups and affiliates organize: to strengthen positive youth development.

Pragmatically speaking, 4-H groups tend to organize around geography or common interest. The need for a new group is identified by the perception of a missing link in the positive youth development chain and the desire among a group of youth/adults to fill the void. Sometimes, existing groups become too large/unwieldy and a well-considered split strengthens the whole.

Whatever the reason for new group formation, good timing is critical. The South Dakota 4-H project year starts in October so a well-considered group would initiate the formation process in the early summer to be ready for a solid start in the fall. A special interest club might form after the conclusion of an event of common interest, thereby building upon newfound momentum. Too often we observe groups forming in haste or as a result of perceived crisis—this is rarely a firm foundation to launch and these groups usually do not last.

What type of group?

South Dakota 4-H recognizes several group designations. Use the descriptions below to consider which group-type designation is most appropriate for your goals. Once decided, proceed to the chartering process (if applicable).

- 4-H Community Club: advised by 2 or more certified volunteers; comprised of 5 or more member youth from at least 3 families (10x4 recommended); open to all would-be members without respect to project types or other factors; usually the club is formed around a particular geographic location; meets 6 or more times spread out throughout the 4-H project year; elects youth officers; youth governed and led with volunteer assistance; focus is on positive youth development through project work, community service, social opportunities, and leadership development; may or may not have a treasury depending on club needs; annual charter relationship required

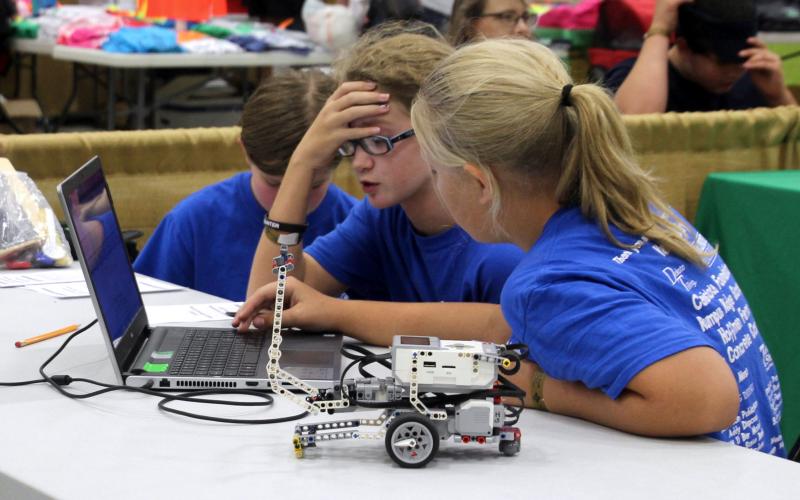

- 4-H Special Interest (SpIn) Club: advised by 2 or more certified volunteers (or 1 volunteer + 1 staff); comprised of 5 or more member youth; open to all would-be members with interest in club’s specified purpose; geographic location is less important to the membership and often these groups are county-wide in scope; meets at least 4x but could be more intensive/seasonal rather than throughout the year; youth governance is not the focus so typically led by adult volunteers or staff; narrowly focused on positive youth development through special interest topic (e.g., robotics, horses, gardening); may only have a treasury if it uses youth governance model and no staff member handles the finances; annual charter relationship required

- 4-H Affiliate: any entity which desires to use the 4-H name or emblem without being a chartered club; usually comprised of adult supporters and volunteers though ideally would include the voice of youth; generally organized to strengthen 4-H positive youth development through fundraising, marketing, and event support; usually has a treasury; supports but does NOT exercise governance over the 4-H program; common examples include 4-H leader associations or endowment committees; annual charter relationship required

- 4-H Independent Study: not a group but an option for individual youth to have 4-H membership; typically occurs when travel distance or other limiting factors make club-based membership unviable; no meeting or governance requirements; focus is on positive youth development through independent project study and participation in larger 4-H events of interest; no charter relationship

- Sponsor or Partner: not a 4-H club or affiliate but an entity which provides independent support to the 4-H program; does not use the 4-H name or emblem in its title or fundraising efforts unless authorized; no charter relationship but sometimes a memorandum of understanding; common examples include local civic groups/foundations, corporate donors, and county fair boards

Chartering

Why charter?

We charter 4-H groups to give them official recognition and status, as well as assure that they know how to use the 4-H name and emblem appropriately. The 4-H name and emblem is very important to us as an organization because it represents who we are and what we stand for to the public. Use of the 4-H name and emblem is controlled and belongs to South Dakota 4-H under previous/historic designations of the USDA. Anyone using the 4-H name or emblem must obtain permission to use it, which is granted when they receive chartered status. Use can be revoked at any time.

Steps to group formation and chartering

Now that you have a motivated collection of individuals and know what type of group you would like to form, you are ready to proceed to the group formation stage. Please proceed with the following steps:

- If you have not yet done so, approach your local 4-H professional for guidance and support. He/she may have information that will strengthen your start, discourage unnecessary overlap, and/or alert you to local expectations for your group-type. The 4-H professional will also verify that you have enough certified volunteers to meet South Dakota 4-H safety standards. Once you have completed these elements, you are ready to fill out the necessary charter application paperwork.

- Complete and submit the appropriate Charter Application packet (Appendix A, B, or C depending on group type) to your local 4-H office.

- If your group will have a formal treasury, complete the Employee Identification Number (EIN) Registration Process with the IRS simultaneously, as you will need this information for the Charter Application. See below for more information on your relationship to the IRS.

- It may take a couple of meetings with your group to identify accurate Bylaws; this is encouraged so they are well-considered and represent the wishes of the group.

- The local 4-H office (within 10 business days) and state 4-H office (10 additional business days) will review your submission packet and, unless any revisions are necessary, will certify your charter for the first year. A charter copy will be added to your profile in 4-H Online.

Upon certification, your group is considered a duly chartered club or affiliate of the South Dakota 4-H program and may move forward with its activity/meeting schedule.

Rights and Responsibilities of Chartered 4-H Groups

Any South Dakota entity wishing to use the 4-H name and emblem must receive permission from South Dakota 4-H. Organized groups must maintain a charter relationship. Effective with the 2020 4-H season, charters are renewable on an annual basis at the discretion of South Dakota 4-H. Chartered 4-H groups may use the 4-H name and emblem as outlined in the South Dakota 4-H policy Overview. Some simple tips for maintaining good status as a chartered 4-H group are as follows:

- Follow your constitution and bylaw standards.

- Provide equal access to all participants.

- Uphold a culture of positive youth development at all gatherings.

- Do not misuse the 4-H name or emblem.

- The name “4-H” is a powerful fundraising tool; be a good steward of 4-H funds.

- Remain in healthy communication with South Dakota 4-H staff (local and/or state).

- Provide all annual reports required by the IRS and South Dakota 4-H (local and/or state).

Your Relationship to the IRS

If your group has a treasury (and therefore an EIN) this is the opportune moment to discuss your group’s relationship to the Internal Revenue Service (IRS). Before we dive in, a brief history lesson will provide helpful context.

From 1946 to 2001, the IRS allowed the USDA to organize local 4-H clubs through a general exemption. This meant that as long as the local 4-H professionals maintained reasonable fiscal oversight of local 4-H clubs, they were in good standing as charitable organizations with the IRS and no annual reports had to be filed. This all changed with 9/11 and the subsequent concern over international terrorism financing. The resultant USA PATRIOT Act of 2001 placed small non-profits (like 4-H) under a new microscope and required the USDA to find a new solution for 4-H clubs. Unfortunately, a nationwide solution was never identified and states spent several years seeking better guidance. Next, the Pension Protection Act of 2006 required previously unbothered non-profits to file annually with the IRS, even if they had little income. Finally, in 2019 the State of South Dakota determined that 4-H club and affiliate organizations could no longer use the state’s EIN—forcing each 4-H club and affiliate organizations to garner their own.

As a result of these procedural shifts, 4-H club and affiliate organizations today find themselves in the position of being organized almost like independent franchises (think McDonalds™). That is, local 4-H club and affiliate organizations must follow all 4-H requirements to remain in good standing with South Dakota 4-H and use the clover (i.e., golden arches), but are organized more independently than before. This requires more effort on the part of 4-H club and affiliate organizations than pre-2001, but hopefully this mini history lesson aids your understanding of how we have arrived at this point.

Will you generate funds and therefore have a treasury?

If the answer is no, you will not have an EIN or relationship to the IRS—congratulations your group just became easier to manage! Once you make yourself familiar with the Reporting and Disbanding sections in the rest of this document, you may proceed to the appropriate Appendix A, B, or C to start your 4-H charter paperwork.

For many of our 4-H club and affiliate organizations the answer is yes—if this applies to you, follow the directions below:

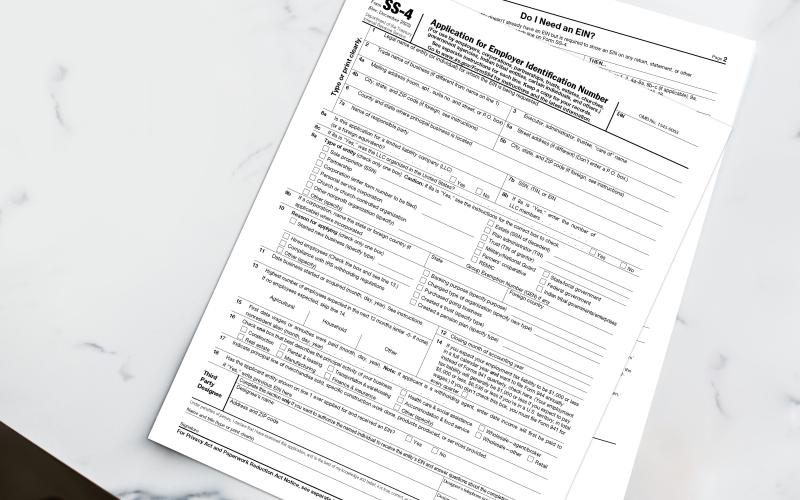

Step 1: File IRS Form SS-4 online to secure an EIN

- See Appendix G of this document for guidance.

Step 2: Receive EIN from the IRS

Step 3: Complete your 4-H charter paperwork

- Use Appendix A, B, or C of this document depending on your club/affiliate type.

Step 4: Become tax exempt with the IRS, by choosing one of these two paths…

Path 1: Expected treasury of less than $5,000 and no plan to accept corporate donations

- This was formerly known in South Dakota 4-H as a ‘basic’ non-profit.

- No cost. No initial tax-exempt application to file. Most 4-H clubs/affiliates should organize this way as it requires very little technical tax expertise.

- Considered a 501c3 charitable organization, but without IRS recognition status. In layman’s terms, this means you will have no document you can provide to donors who request verification of your tax-exempt status.

- Falls under the guidance of “Organizations Not Required to File Form 1023” available at the IRS webpage.

- Reminder for Path 1 groups: The SDSU Foundation is available to process most corporate donations for a fee of 5% per transaction; the 4-H State Leaders of South Dakota also provide this service for free.

- Annual reporting to the IRS (usually each May): In your first year, you must contact the IRS Account Services Unit prior to the initial 990-N e-Postcard filing at (877)-829-5500 to request the IRS set up your organization’s account. Only then will you have the online access necessary to file the e-Postcard. After that, it is a simple online filing each year thereafter to maintain tax exempt status. Editor’s note: Few who have attempted this process have met with success. Those who have succeeded have shared the following advice:

- Pro Tip #1: Have your EIN letter at the ready. Your goal is to only call one time, so be prepared with all your club materials the first time!

- Pro Tip #2: Once you have made it through to a real customer service representative, you will want to identify yourself as follows: “Hello, I am a new tax-exempt organization with receipts of less than $5,000 annually. Please help me get set up to file my first 990-N e-Postcard.”

- Pro Tip #3: Since 2020 it has been IRS practice for their customer service representative to share with you the benefits of going the Path 2 route described below. Do not allow this persuasive technique to confuse you; stick to your guns and politely proceed with your initial request.

Path 2: Expected treasury of less than $5,000 and wants to accept corporate donations OR expected treasury of more than $5,000

- File initial application using IRS Form 1023-EZ or 1023.

- As of 2020, initial filing fee cost is $275 for groups with less than $50,000 in anticipated revenue or a $600 fee for those exceeding $50,000.

- Strongly encourage that only groups with stable, functional governance and local access to accounting professionals go this route.

- Though Path 2 is the right choice for a select few 4-H club and affiliate organizations, it is the non-preferred pathway due to the greater liabilities posed, and as such, no technical expertise is available from South Dakota 4-H employees.

- Annual reporting to the IRS each May:

- To confirm which 990 series to file, check here.

- Additional guidance available here.

Legal Notice: Although the IRS information contained in this section is designed to offer general tax information, it is not a substitute for advice obtained from the IRS or a qualified tax professional. The information in this section is subject to change or further interpretation by the IRS or other tax authorities and/or SDSU policy updates.

SDSU Extension 4-H Fiscal Standards

If your group has a treasury, SDSU Extension 4-H provides a number of standards to ensure appropriate fiscal stewardship and thereby maintain public confidence in our program. All chartered 4-H group accounts must adhere to and all funds must be maintained in accordance with the following guidelines:

General Fiscal Guidelines

- All funds are required to be secured in a federally insured bank account (checking, savings, or certificate of deposit). Funds may be maintained in other investment accounts with the knowledge and approval of the SDSU Extension State 4-H Program Director. All 4-H club and affiliate organizations funds are required to be used for 4-H programs and activities.

- All disbursements must be made through an organization’s checking account. Funds withdrawn from savings or other investment accounts must be deposited into a 4-H club and affiliate organizations checking account before it can be disbursed. Cash payments for supplies and/or services are prohibited.

- Checks written on 4-H club and affiliate organizations accounts must have two signatures. One signature should be that of the Club Treasurer and the 2nd that of a non-related adult. It is recommended that the club treasurer and two adults be authorized on the accounts. For Affiliated Organization accounts two signatures (treasurer and non-related adult) are required. All authorized signatures need to be on file with your financial institution.

- Rubber stamps may not be used as the primary approval signature on 4-H club and affiliate organizations disbursements. The second authorizing signature may be a rubber stamp with written (e.g., email) approval prior to each use. This is especially helpful when the secondary authorizer lives at a distance. Maintain all written approvals of stamp usage for the annual fiscal audit conducted by the 4-H club and affiliate organizations.

- SDSU employees are prohibited from being an authorized signatory on any

4-H club and affiliate organizations accounts. - All 4-H club and affiliate organizations accounts must have an EIN number or fall under another 4-H club and affiliate organizations’s account as a dedicated sub-line. This is a financial institution requirement.

- All funds collected must be handled in a manner that will maintain the public trust in our program. The handling and maintenance of these funds should pass the sunshine test which states: “If all our fund records were published in the local paper, the public consensus would be that they were well managed.”

- All 4-H club and affiliate organizations accounts should be examined on an annual basis by a certified public accountant, a degreed accountant or business administration individual, a qualified county administrator/commissioner, elected Audit Committee of the 4-H club and affiliate organizations, or a county SDSU professional. The audit should include an evaluation of the internal controls for cash receipts and expenditures. The review, at a minimum, must ensure that all of the 4-H club and affiliate organizations accounts have been independently reconciled. The auditor/reviewer must not be a relative of any individual that has signature authority on the account.

- A copy of the audit report should be maintained with the 4-H club and affiliate organizations financial documents and produced upon request by 4-H staff.

Cash Receipt and Deposit Procedures

- Establish a verifiable record of all cash and checks received:

- All collections must be recorded on a multi-copy (at least two) pre-numbered cash receipt form.

- A copy of the form should be available to the customer as evidence of payment.

- Offices should file the second copy (yellow) securely bound in a book to better control and account for the documents.

- The receipt should record the following information: date of payment, payee, dollar amount, method of payment (cash or check), program for which funds were received and the name of the staff member preparing the receipt.

- Checks should immediately be endorsed “For Deposit Only.” Endorsements should include the 4-H club and affiliate organizations bank account number.

- Adequately secure and safeguard un-deposited cash receipts:

- Un-deposited cash and checks should be transferred to a designated custodian (Club Treasurer). The Club Treasurer can also receive funds directly from the public and process cash receipts by mail.

- All transfers of money to the designated custodian should be documented by having the custodian initial the file (yellow) copy of the cash receipt form once the funds come into her/his possession.

- The designated custodian is required to secure the funds in a protected location. No other staff member should have access to funds once the receipts are transferred to the designated custodian.

- A designated substitute treasurer/custodian can be appointed to cover extended periods of leave; however, the substitute is required to document the transfer and properly secure funds for which he/she is responsible.

- Employees are not allowed to cash personal checks from un-deposited funds.

- Night depositories should be utilized when funds exceed $500.

- Verify to ensure that all funds are deposited:

- Deposits shall be made at least weekly. More frequent deposits should be made when un-deposited amounts exceed $500.

- The designated cash receipt custodian (Club Treasurer) is responsible for preparing deposits.

- All deposits must have sufficient documentation noting which checks and/or cash receipt forms were included in deposit balances. This documentation can consist of notations in a bound cash receipt book, or a listing of each cash receipt form that was included in the deposit.

Inventory and Sales Procedures

When conducting fundraising events that involve sales of merchandise to the public, adequate documentation of items sold should be maintained. Proper inventory audits/controls should be followed, particularly in entities like Shooting Sports clubs which maintain significant equipment. An annual audit of equipment should be completed and filed with the club treasurer and produced upon request by 4-H staff.

Disbursement Procedures

Appropriate record keeping when conducting transactions is particularly important. Key points are identified below:

- All expenditures must be approved by the 4-H club and affiliate organizations.

- An original invoice should be presented to the 4-H club and affiliate organizations requesting payment and be approved for payment by its members.

- Upon club approval of the invoice the Treasurer shall make payment.

- The original invoice or receipt should be attached to the voucher form.

- All disbursements must be made through an organization’s checking account. Funds withdrawn from savings or other investment accounts must be deposited into a 4-H club and affiliate organizations checking account before they can be disbursed. Cash payments for supplies and/or services are prohibited.

- Checks written on 4-H club and affiliate organizations accounts must have two signatures. One signature should be that of the organization’s Treasurer and the second that of a non-related adult.

- Checks must never be pre-signed. Using a rubber stamp in lieu of an original first signature is forbidden.

Accountability Procedures

- It is the responsibility of every staff and 4-H club and affiliate organizations member to report the suspected misuse of funds to the SDSU Extension State 4-H Program Director.

- Any loss of funds due to fraud or misappropriation can result in disciplinary action including termination and criminal prosecution.

Investment Accounts

4-H club and affiliate organizations’s may, upon approval of the SDSU Extension State 4-H Program Director, maintain investment accounts for the purpose of accruing earnings on the deposited funds. Scholarship funds are often established and funds are deposited into such accounts. Investment accounts may include, but are not limited to, money market funds, CDs, stocks, and mutual funds. Crypto is not permitted. The following guidelines should be followed when managing these investment accounts:

- 4-H club and affiliate organizations’s utilizing investment accounts are encouraged to use outside professional sources to aid them in their investment strategies; banking, accountants or investment professionals would be a great source of support. The decision as to how to invest funds is ultimately the responsibility of the 4-H club and affiliate organizations, but the advice of the outside professionals should be carefully considered and funds should always be invested in a fiscally responsible manner.

- As with all other accounts, investment accounts should be reviewed annually and a report submitted to the State 4-H Office.

- In order to provide a means of tracking disbursement of funds, monetary awards should be in the form of a check. To expend investment account funds, the funds should first be transferred into the regular 4-H club and affiliate organizations checking account and the checks written from that account.

Notes on Tax Exempt Status (some items highlighted again for clarity)

- Each local 4-H club and affiliate organizations with funds must have a federal employee identification number (EIN ID #) for each account. This number is to be used in filing annual tax reports, establishing federal income tax exempt status, reporting to the State 4-H Office, and for identifying all accounts.

- As a reminder, effective FY-2019 4-H club and affiliate organizations are responsible for filing their own annual tax report with the IRS by the May 15th non-profit filing deadline. SDSU 4-H is no longer able to complete this reporting process on your behalf or provide tax guidance beyond this document.

- Federal tax-exempt status does not exempt the 4-H organization from paying South Dakota sales tax. Only purchases processed through SDSU are tax exempt.

- Contributions to an official 4-H club and affiliate organizations by individuals, organizations, and corporations are deductible as a contribution for federal income tax purposes for 4-H club and affiliate organizations that chose Path 1 or 2; however, most large corporations these days will require evidence of your IRS status which is only available for Path 2 groups.

- Historic USDA policy and federal law prohibited the misuse of the 4-H name and emblem. Any funds collected using the 4-H name and emblem must be used for 4-H purposes (and returned to an appropriate South Dakota 4-H entity should they go unspent).

- Non-profit organizations are just that—not out to turn a profit. To ensure this, 4-H club and affiliate organizations will usually spend down all revenues and maintain start-up carry-over funds of less than $5000. In circumstances where 4-H club and affiliate organizations need more than $5000 carry-over, they shall attach their fund expenditure plan to the Annual Charter Renewal form (Appendix E).

Annual Reporting

Throughout this document you have noted a concerted effort to maintain the high standing of 4-H in our communities by following appropriate procedures. Reporting is the final “check and balance” to ensure civil rights, organizational charter, and fiscal stewardship standards are in good position. To that end, South Dakota 4-H requires each 4-H club and affiliate organizations to complete two annual reporting requirements. With good recordkeeping throughout the year, the annual reporting process will take the average 4-H club and affiliate organizations about 15 minutes. See as follows:

- South Dakota 4-H Requirement: Complete the Annual Charter Renewal form (Appendix E) and give to your local 4-H professional by December 31. This 2-page form simplifies the previously required audit paperwork, civil rights assurance, and financial report summary report.

- IRS Requirement for 4-H club and affiliate organizations with a treasury: File the appropriate annual IRS notice/report by the May 15th tax-exempt org reporting deadline.

- For most 4-H club and affiliate organizations (i.e., Path 1 groups) this will involve filing the 990-N e-Postcard; a simple 5-minute online filing process at the IRS website.

- Use this guide to navigate the e-Postcard.

- Pro Tip: save your password information in a secure location. This will save you a significant amount of grief next year!

- Path 2 groups will usually file the more detailed 990 or 990-EZ; consult your local tax professional.

- For most 4-H club and affiliate organizations (i.e., Path 1 groups) this will involve filing the 990-N e-Postcard; a simple 5-minute online filing process at the IRS website.

Disbanding

When the positive youth development mission and/or the group’s intended purpose are no longer manifest, it is time for the group to re-focus or potentially disband. If the attempt at re-focusing falters, disbanding shall be conducted in a manner that provides the least disruption to 4-H member youth. If a treasury exists, disbursal of funds within the bounds of 4-H charter obligations must be followed or criminal liability may result. Based on observed patterns, the following guide may help your group decide if re-focusing or disbanding may be in order.

When to re-focus

- A planned or sudden loss of a key volunteer weakens the group, but other caring adults are available to ‘step up.’

- Meetings have grown stagnant but reaching out to staff for creative ideas will likely spice things up again.

- An experienced group of youth graduates simultaneously and though the group is now very inexperienced there is potential for strength after a few years of patient growth.

- Disagreements are happening amongst the group’s leadership, but an independent observer would suggest the disagreements are petty rather than substantive. 4-H staff can assist with conflict resolution or interpersonal communications training.

- For one reason or another, the culture of positive youth development has been lost in the group but the membership is full of good people that just need a training stimulant (from staff) to get back on track.

- Minimum participation requirements are not being met but with an active recruiting cycle new members are likely to join.

- The organization receives notice from South Dakota 4-H staff (local or state) that certain improvements are needed to maintain the club/affiliate. The club/affiliate appreciates the constructive feedback and makes appropriate adjustments to get back in good standing.

When to disband

- No adults are willing to step up when existing volunteers are lost.

- The group has become so petty or derisive that the culture of positive youth development is no longer present.

- Minimum participation requirements are not being met, and despite active recruitment, new members are unlikely to join.

- The group no longer has a need to be a group (e.g., everyone graduated, SpIn interest has faded).

- The organization receives notice from South Dakota 4-H staff (local or state) that certain improvements are needed to maintain the club/affiliate. The club/affiliate chooses not to embrace the necessary change and decides to disband.

How to disband

Hopefully you have been in ongoing communication with your local 4-H professional well in advance of this moment. If disbanding is the best option, you will need to complete the following basic steps:

- Communicate effectively with all remaining group members that the group is disbanding. Generally, this will take place at a final meeting and a vote will be taken and recorded in the final minutes. Do your best to conclude on a positive, civil note.

- If a treasury exists, the group will vote on how best to disburse remaining funds. South Dakota 4-H requires that remainder funds be distributed to a) another South Dakota 4-H entity or *b) a local non-profit that means something to the group. If consensus cannot be reached or the group disbands without taking a proper concluding vote, all funds automatically revert to South Dakota 4-H. Under no circumstances may funds be disbursed to individuals/members or used for a final ‘blowout’ party.

*By way of reminder, funds raised in the name of a 4-H entity must remain with an overall 4-H entity. For those choosing to dispense some monies via Option B above, be sure those were only funds generated by member dues from the current year and not via fundraiser or donors. Usually, it is safest to give to another 4-H entity. - If a treasury existed, the group leader will also need to file the final IRS 990 e-postcard by May 15th and note in that filing that the group has been terminated. This is how you successfully terminate the relationship with the IRS.

- Final Step: Turn in the Revocation of Charter form (Appendix F) to your local 4-H professional. The form verifies completion of previous steps.

Appendices

Note: a new group should only fill out A, B, or C—not all three!

Appendix A - Community Club Charter Application Packet

This is an all-in-one form for community club charters, which should be completed and submitted to the local 4-H professional for initial consideration.

Appendix B - Special Interest Club Charter Application Packet

This all-in-one form is for special interest club charters, which should be completed and submitted to the local 4-H professional for initial consideration.

Appendix C - Affiliate Charter Application Packet

This all-in-one form is for affiliate charters, which should be completed and submitted to the local 4-H professional for initial consideration.

Appendix E - Annual Charter Renewal Form

This all-in-one renewal form is to be completed and submitted to your local 4-H professional by December 31 to request continuance of the charter relationship.

Appendix F - Revocation of Charter Form

This form is to be completed and provided to the local 4-H professional upon the chosen termination of the 4-H group.

Appendix G - Form SS-4 Instructions

This is an example demonstrating how to fill out the online EIN (SS-4) form from the IRS.