Search

High-Quality and Affordable Protein Options

Protein is an essential part of the human diet and can come from many sources. Learn about some protein options to build resiliency when certain proteins are experiencing shortages or increased costs.

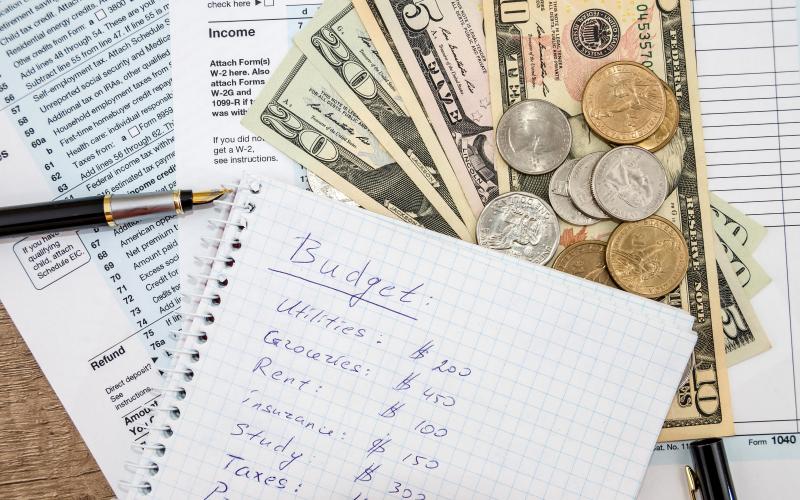

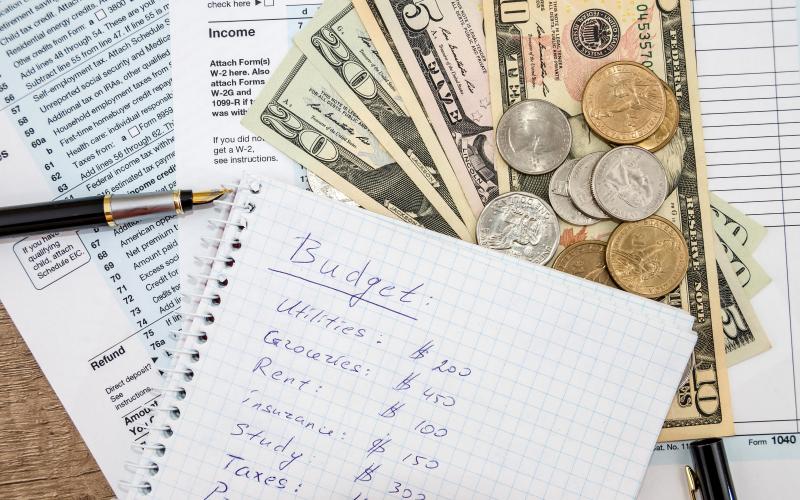

Prepare Your Finances for Emergencies

Preparing your financial records preemptively can help your family stay safe and prepared when disaster strikes. Learn some expert tips for getting started today!

Wise Spending Habits

Does your paycheck run out before the end of the month? Do you spend more than you earn? Your wants may possibly be getting in the way of your needs. Priorities will need to be set to help manage money. Almost everyone can find some expenses to cut or reduce.

How to Find and Pay for Home Modifications

This resource was developed to help you understand how to pay for home modifications in North Dakota and South Dakota, as well as describe some of the challenges you may encounter as you search for businesses or organizations to renovate your home for you.

Health Savings Account vs. Flexible Savings Account: Which is best for me?

Having a health insurance plan does not mean that all medical expenses are covered. Health savings accounts (HSA) and flexible savings accounts (FSA) are designed to help consumers budget for deductibles, co-pays, prescription costs, out-of-pocket costs, and other unexpected medical expenses.

PowerPay: Debt Management Tool

PowerPay is a free debt management tool created by Utah State University Extension. It helps users calculate how long it will take a person to pay off debt with multiple different plans.

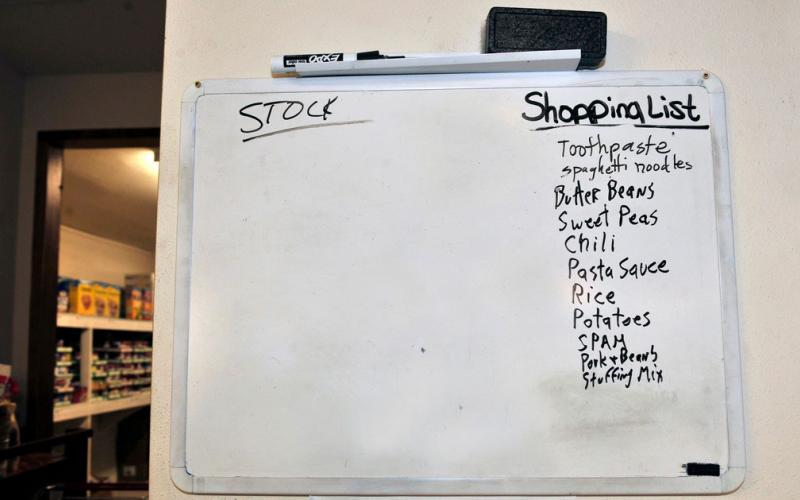

Helpful Food & Shopping Tips During Unexpected Events

When faced with unexpected events, such as a health crisis or natural disaster, planning meals and grocery shopping often comes to mind along with questions: What should I plan to make? What groceries do I need?

Student Loan TIPS (Texting Intervention Program)

According to U.S. Department of Education data, 30% of federal student loans were in deferment and forbearance while 7% were in default (Cho, Johnson, Kiss, O’Neill, Mountain, & Gutter, 2016).

Planning for Retirement

No matter what your age or when you plan to retire, now is the time to begin saving for retirement. Learn. some tips to help you become more financially secure as you prepare for retirement.

Protecting Yourself From Frauds and Scams

Tactics used by scammers have shifted drastically in recent years, with online scams rising 87% since 2015. Learn how to ecognize and protect yourself from some of the most-common scams in South Dakota.