The holidays are a time to spend with family and friends sharing good food and gifts. Rising prices of necessities such as food, transportation, and housing can impact spending and can be more stressful for individuals and families who are living on a tight budget. The extra gifts, food, and travel expenses can make a budget that is already stretched, snap. Planning and making spending decisions will help the holidays be more enjoyable.

Tips to Plan for Holiday Expenses

- Make a list.

- Who do you want to give gifts to this holiday season? Family is usually at the top of the list. Are there close friends, co-workers, or individuals in your children’s lives that you want to include on the list? Think about who you want to give gifts to not who you feel you need to give a gift to. Be realistic, you have a limited budget, and streamline your list so you feel good about giving to the people who mean the most to you.

- What events will you need to bring or provide extra food? Will you have extra people at your home that will increase your food budget? If your children have time off from school, how much additional food will you need to have on hand to make sure they are fed?

- Will you be traveling more during the holidays? What will the transportation expenses be? Will you need to stay at a hotel and purchase food?

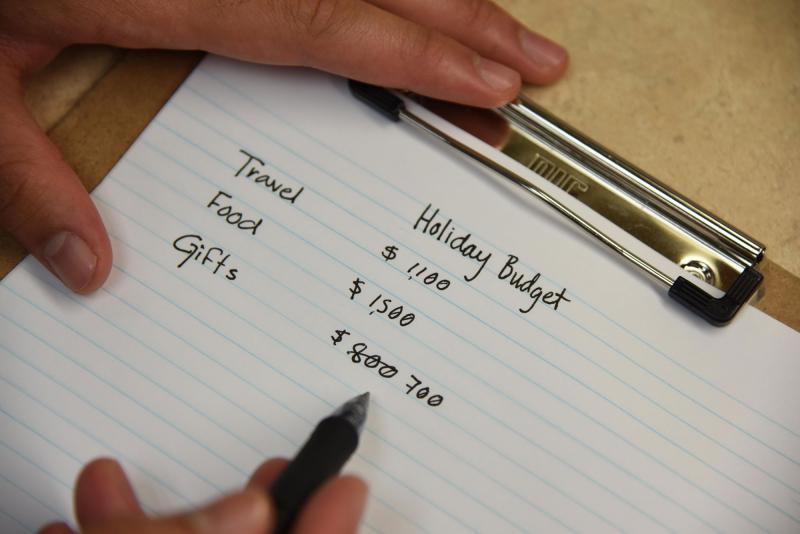

- Develop a budget.

- Review what you spent during the previous holiday. Use that amount as a place to start budgeting for this year’s gifts, food, and transportation. Reflect on how much you spent. Do you remember feeling like you spent too much or was it just right? Did your spending leave you with limited savings or debt that you paid for all year?

- For each recipient, list a specific amount you want to spend and ideas for the gift. Research to determine the prices of the items to make sure your amount is realistic. Consider the needs of the recipients when thinking about the gift you want to give. Do school supplies need to be replenished? Do electronics or electronic accessories need to be replaced? What about clothes? Is there an upcoming occasion where a special clothing item will be needed? Purchasing gifts that meet a need will reduce expenditures in future months.

- Remember to include wrapping paper, bows, gift bags, tape, postage, and cards in the budget for holiday expenses. Look through what you saved from the last holiday to determine what needs to be replaced.

- Be very thorough when developing your holiday budget. Identify a specific amount of money you want to and can spend for each expense.

- Review your regular monthly budget to include the holiday expenses.

- Before you can figure out your holiday spending, you need to know where the money will come from. Review your regular monthly budget so you know which category of expenses you can adjust to have money for holiday spending. Consider reducing or eliminating expenses that can be held off for the month. Look at the holiday expenses that would fall into your current expense categories.

- For higher food expenses, remember that you don’t need to buy more expensive food or food that doesn’t usually fit into your budget. For holiday baking, select recipes that use ingredients you usually purchase. Make a double batch of one or two recipes instead of several different recipes. Recipes with added candies, chocolates, and nuts can become more expensive. Use this same rule when planning meals and main dishes. Throughout the holiday month, purchase food items you will need for your food prep that is on sale instead of making one big shopping trip. Plan recipes using sale items. Stacy Shelsta, Department of Social Services Benefits Specialist Supervisor for Brookings, Lake, Moody, and Kingsbury counties of South Dakota, recommends for SNAP recipients save benefits for more expensive times of the year. Additionally, individuals and families can look for community events that provide meals for holidays. Incorporate food baskets and other holiday giveaways into the plans for the meals to reduce food expenses.

- If transportation expenses will be higher during the holidays, try to reduce unnecessary travel to save on gas. Take advantage of any gas deals that are offered at your local gas station. Carpool with others to share the expenses.

- For gifts that do not fit into regular budget expense categories, this month you will need to create that budget category. Review your list and the amount of money you had planned to spend. Don’t include amounts you have already incorporated into other budget categories (food and transportation). Does the amount easily fit into your budget or do you need to make adjustments? Revise your gift list if you are over budget. If you don’t have the money, you have to reduce your expenses.

- Find additional income.

- If you have reviewed and revised your holiday budget and it still does not balance, consider sources of additional income.

- During the holiday season, many retailers are hiring temporary employees. Consider getting a part-time job to help with the expenses. You may have the added benefit of receiving store discounts that can help with your spending.

- Declutter and selling the extra items around your home is a task you can do year-round, but during the holidays, this could be a good source of funds to help with the holiday budget.

Once You Have a Plan

- Stick to the budget.

- Now that you have done all the work to plan your holiday budget, you need to stick to it. Before you go shopping in addition to making a list of who you are shopping for, include the amount of money you have planned to spend. As you begin buying, make a note of how much you spent so you don’t overspend.

- Avoid impulse spending.

- If you have your list when you are shopping, you will be less likely to make impulse purchases. When you go shopping, know which gifts you are looking for and stop when you are finished.

- Avoid using credit.

- Using credit to purchase holiday gifts when you won’t have the funds to pay the balance of the debt next month should be avoided.

- Don’t overspend for the holidays because the rest of the year’s budget will have to focus on paying the debt.

- If you already have a tight budget, adding debt payments will make it tighter throughout the year.

- Shop smart.

- Know the average price of the items on your list so you know when the sale is a deal. Don’t get caught up in the BOGO (buy one get one) sale if you don’t need the second item. Do online research to compare prices. If you are shopping online, also look for shipping deals.

You are in control of the decisions you make about spending. Make a plan for your holiday budget that works for you and stick to it. Be realistic and most importantly focus on the time you are spending with friends and family, not on the stuff you exchange.