Search

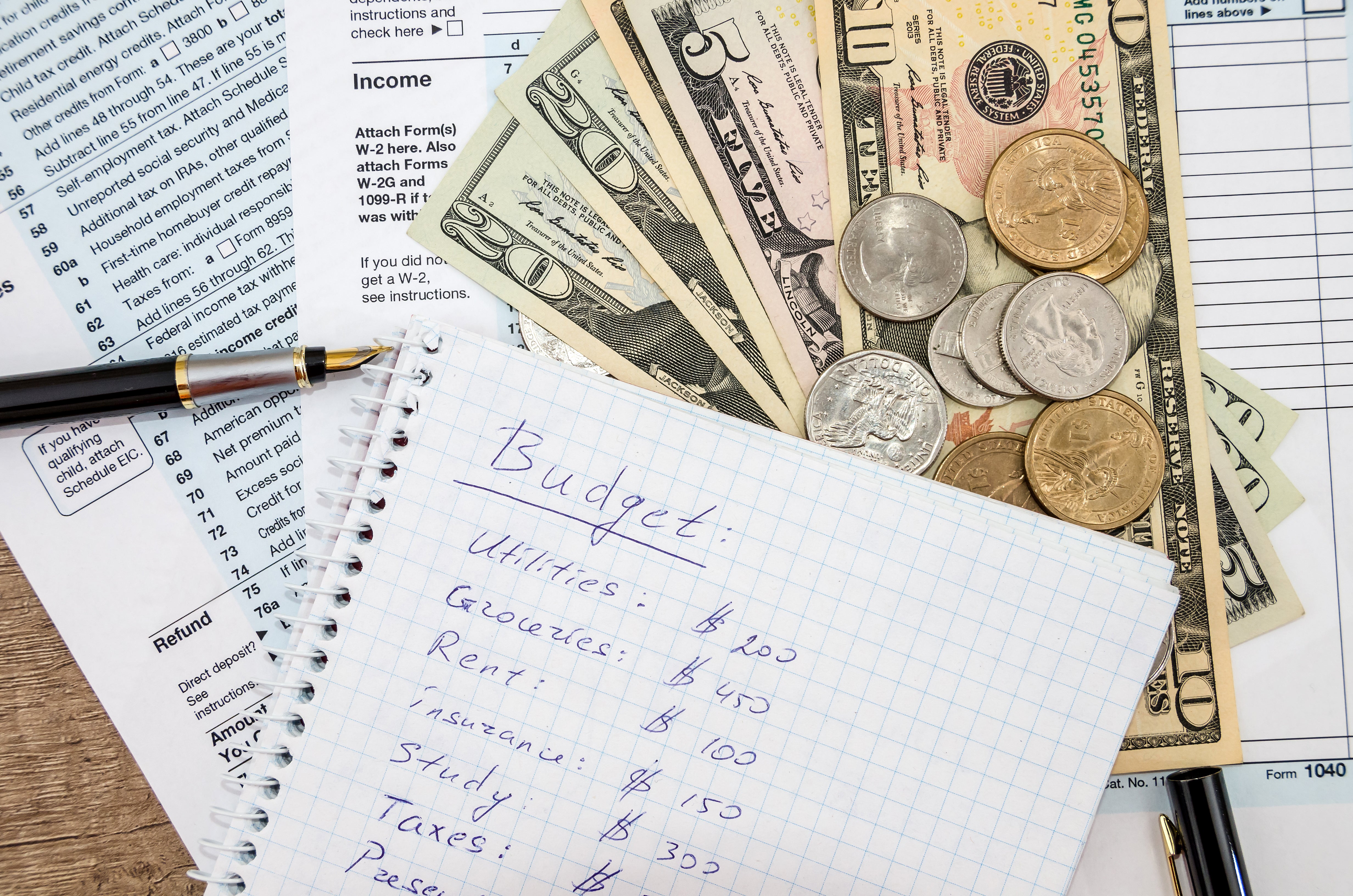

4 Tips for Managing Money on a Low-Income

The number of families in the United States whom are in poverty is increasing. Nearly one-third of all working families or 10.4 million families are considered low-income.

Cleaning Out Your Closets: Donate to kids to help build creativity

If you have things you are unsure what to do with and don’t want to just throw them away, think about contacting daycares, preschools, or churches to see if they could use some of the items for their play areas or to make toys/projects for their kids.

Debt Management

Many people face a financial crisis at some point in their life that can make it difficult to pay bills.

Shelf-Stable Foods Save Money and Help Families Stay Prepared

Many people may find themselves feeling worried or concerned about having enough food in their homes. One way to help with these worries and concerns is to purchase canned or dried foods also known as shelf-stable items.

Understanding Your Credit Score

A credit score is an assessment of your creditworthiness. Lenders use the credit score to determine whether or not to lend to you, what the interest rate will be on the loan, and other terms that impact the cost of credit for the consumer.

Predatory Lending & Alternative Financial Services

Predatory lending is an action that targets consumers who are in a vulnerable financial situation in which money is needed quickly to take care of a financial emergency.

Keeping Your Financial Records Secure

When a family emergency or disaster occurs, having quick access to important financial documents is essential.

Planning for Retirement

No matter what your age or when you plan to retire, now is the time to begin saving for retirement. Learn. some tips to help you become more financially secure as you prepare for retirement.

Retirement Saving Strategies

Since people are living longer than ever, retirement savings need to last longer and work harder. It is more important than ever to make smart financial decisions.

Student Loan TIPS (Texting Intervention Program)

According to U.S. Department of Education data, 30% of federal student loans were in deferment and forbearance while 7% were in default (Cho, Johnson, Kiss, O’Neill, Mountain, & Gutter, 2016).